As global economies grapple with persistent inflation, investors are actively hunting alternative holdings to safeguard their wealth. Among these options, digital gold has emerged as a controversial choice. Proponents argue that Bitcoin's immutable ledger makes it an effective safeguard against inflation, as its value is not tied to fiat currencies.

However, critics doubt the validity of Bitcoin as a long-term inflation hedge, citing its volatility and lack of regulatory oversight. Ultimately, the choice of whether to incorporate Bitcoin into a wealth management plan as an inflation hedge rests on individual financial goals.

Protecting Our Legacy: The Emergence of Bitcoin Reserves

The financial landscape is undergoing a seismic shift. Traditional firms are reluctantly to adapt the disruptive potential of decentralized finance, and at its epicenter stands Bitcoin. As institutional acceptance accelerates, a new paradigm is emerging: the rise of Bitcoin reserves.

This trend points towards a profound reconfiguration of wealth, as forward-thinking investors appreciate Bitcoin's intrinsic value as a store of value. From hedge funds to pension plans, major entities are diversifying their portfolios with Bitcoin, building reserves that mitigate against the volatility and uncertainty of traditional markets.

{Ultimately|, The long-term implications of this shift are profound. As Bitcoin reserves accumulate, it will further solidify Bitcoin's position as a foundation of the global financial system, spurring innovation and enabling individuals to control their own well-being.

Constructing Financial Resilience Through a Bitcoin Strategic Reserve

In today's volatile economic landscape, preserving financial stability is paramount. A Bitcoin strategic reserve presents a compelling opportunity to reduce risk and strengthen long-term financial well-being. By allocating a portion of assets to this decentralized digital instrument, institutions can spread their holdings, safeguarding against traditional financial market vulnerabilities.

- , Additionally , Bitcoin's finite supply and transparent ledger offer a unique hedge against currency devaluation.

- , Therefore, integrating Bitcoin into a strategic reserve can provide a valuable layer of defense against unforeseen economic shocks.

- , Finally, adopting a Bitcoin strategic reserve is a proactive approach to navigate the complexities of modern finance and secure long-term financial robustness.

Policymakers Pondering Strategic Bitcoin Holdings

With the dynamic nature of the copyright market, financial institutions globally are increasingly considering the strategic advantages of holding significant amounts of get more info Bitcoin as part of their holdings.

This move comes amid {growingacceptance of Bitcoin as a legitimate store of value, and worries about the durability of established financial systems. Some economists believe that Bitcoin could serve as a safe haven asset in a interconnected economy facing uncertainties. However, others warn that the high volatility of Bitcoin make it a risky asset for governments to hold in large quantities.

- Reasons behind this interest include:

- Possibility of mitigating inflationary pressures

- Exploration of alternative investment strategies

- Growing recognition of Bitcoin's technological innovation

The long-term outlook of governments' involvement in Bitcoin remains indeterminate. Nevertheless, this trend is certain to have significant implications for both the copyright market and the global financial landscape.Whether governments will ultimately embrace Bitcoin as a strategic asset or remain wary remains to be seen.

Building a Global Bitcoin Strategy

In an era of fluctuating global markets and increasing economic uncertainty, the need for innovative solutions has never been greater. One such solution that has gained considerable traction is the concept of a Global Strategic Bitcoin Reserve (GSBR). This reserve would consist of a significant allocation of Bitcoin, managed by a multi-lateral organization. Its primary purpose would be to provide a resilient store of value against currency devaluation, fostering greater {financial stability on a global scale.

- Advocates of the GSBR argue that Bitcoin's autonomous nature and inherent scarcity make it an ideal instrument for a global reserve currency.

- Furthermore, they posit that a GSBR could reduce the risks associated with traditional currencies and provide a safety net against global instability.

However, the GSBR concept is not without its opponents who raise concerns about Bitcoin's price fluctuations and its potential for abuse. They also question the implementation of such a system, given the complexity involved in establishing a global reserve managed by an global body.

Unlocking Value: The Potential of a Bitcoin Strategic Reserve

A well-structured Bitcoin strategic reserve can maximize the potential value of any institution's assets, offering protection against volatile markets. By strategically acquiring Bitcoin, governments and institutions can reduce their financial resilience and navigate the evolving global economic landscape. This allocation serves as a hedge against inflation, preserving purchasing power over time. Furthermore, it allows for greater financial transparency, potentially leading to increased trust in the long term.

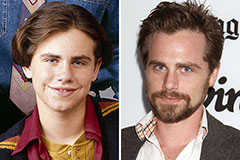

Rider Strong Then & Now!

Rider Strong Then & Now! Brandy Then & Now!

Brandy Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now!